The 50/40/10 Budgeting Rule: Spend Smart, Build Wealth!

Pavleen Kaur

1, April, 2025 4 min read

Your Friendly Guide to Taking Control of Your Finances Without Stress

Ever feel like your salary disappears the moment it hits your account? You’re definitely not alone—and the good news is, there’s a better way to manage your money.

Let me introduce you to the 50/40/10 budgeting rule—a simple yet powerful way to take charge of your finances without giving up your lifestyle.

At TimelyBills, we’ve seen thousands of users transform their money habits with this method. Backed by over 15 years of experience helping people plan smarter and save more, we know what actually works in real life—not just on paper.

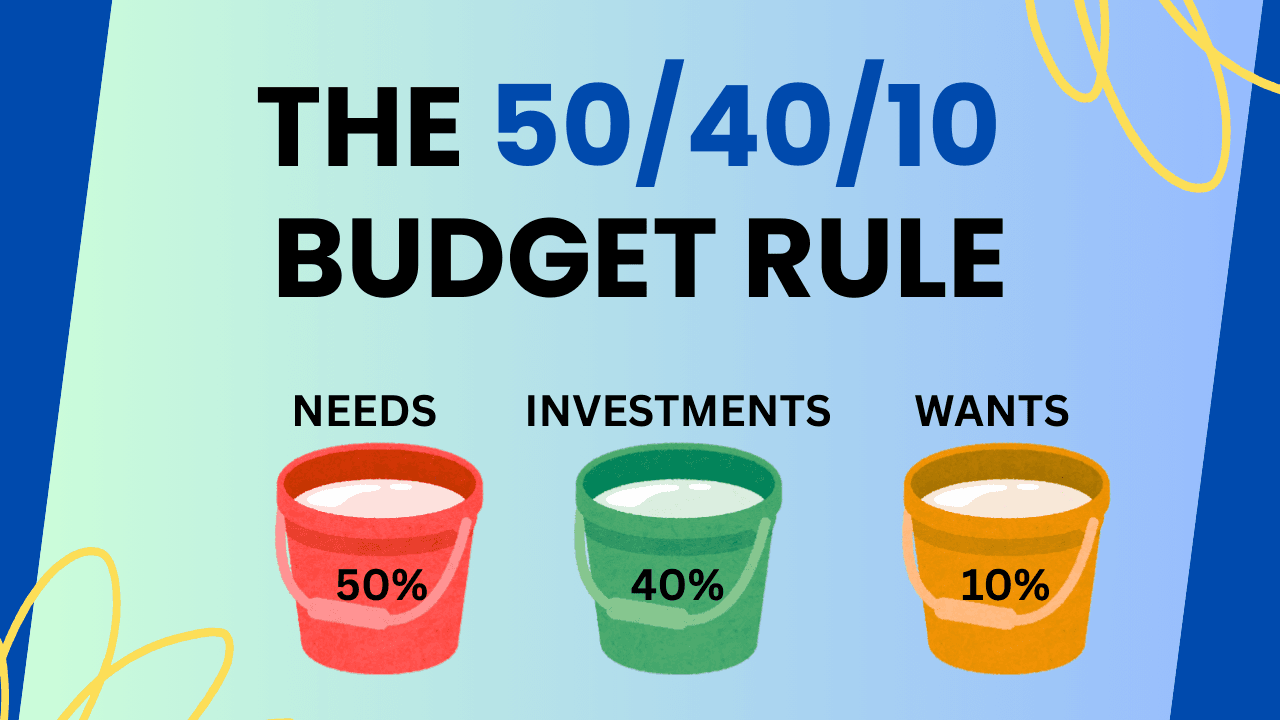

What Exactly is the 50/40/10 Rule?

This budgeting rule is all about balance. It divides your monthly income into three clear buckets:

50% for Needs

Think rent, groceries, utility bills—everything you absolutely need to live and work.

40% for Investments & Savings

Here’s where your future comes in—emergency funds, retirement plans, debt repayment, and investments.

10% for Wants

Yes, you can enjoy your favorite food delivery or Netflix binge—this part is guilt-free fun money.

Why does it work? Because it’s flexible, easy to stick to, and designed to help you build wealth without sacrificing joy.

Step 1: Cover Your Essentials with 50%

Let’s start with the stuff that keeps life moving—your "needs." These should take up no more than half of your income.

Here’s what usually falls into this category:

-

Rent or mortgage

-

Basic groceries

-

Electricity, water, internet

-

Transportation (fuel, metro, cabs)

-

Health and life insurance

-

Loan EMIs or minimum debt payments

If your needs are taking more than 50%, it's a red flag. Time to audit your lifestyle and find where you can reduce spending.

Using a smart bill organizer from TimelyBills can help you stay on top of these expenses—no more missed due dates or late fees.

Step 2: Build Wealth with 40%

Here’s where most people struggle—and where this rule really shines. Instead of letting your entire paycheck slip through your fingers, the 40% rule encourages you to:

-

Create an Emergency Fund: Cover at least 3–6 months of living expenses.

-

Start or Grow Investments: SIPs, mutual funds, PPFs, stocks—choose what aligns with your comfort level.

-

Save for Retirement: Start early, even with small amounts. Compounding is your best friend.

-

Aggressively Repay Debts: The faster you clear loans, the less interest you'll pay over time.

Want to stay consistent? The goal tracker in TimelyBills helps you stay motivated with visual progress bars, reminders, and automated tracking.

Need a clearer view of where your investments stand? The account manager pulls all your financial accounts into one dashboard. That’s the kind of control your future self will thank you for.

Step 3: Enjoy Life with 10%

Let’s face it: if your budget feels like punishment, you won’t stick with it. That’s why 10% is set aside just for enjoyment.

-

Shopping

-

Entertainment & streaming subscriptions

-

Weekend trips

-

Dining out or coffee shop runs

-

Hobbies or personal treats

This “fun fund” is important—it keeps you from feeling deprived while ensuring you don’t overspend.

Want to make sure you don’t cross that 10% mark? The spending tracker helps you stay within your limit while still enjoying every rupee.

Why the 50/40/10 Budget Rule Works (Backed by Experience)

Over years of working with real people on their financial journey, we’ve seen this simple framework help them:

-

Get out of debt faster

-

Save more consistently

-

Reduce anxiety around money

-

Spend more intentionally

-

Enjoy life without guilt

It’s not just a method—it’s a mindset shift. And with tools like TimelyBills’ budgeting app, you can put this rule on autopilot.

You’ll receive custom insights, spending alerts, and even weekly summaries via the reports dashboard. It’s like having a personal finance assistant in your pocket.

Imagine This...

You're no longer dreading the end of the month. You know where every rupee goes. You have savings growing, debts shrinking, and weekends out without guilt.

That’s not a dream. That’s the 50/40/10 life, and it's 100% doable.

Make Budgeting Effortless with TimelyBills

TimelyBills is more than an app—it’s your personal financial companion. Here’s how it makes budgeting easy:

-

Set Monthly Limits : For each category (needs, wants, investments)

-

Get Bill Reminders : Avoid late fees with automatic alerts

-

Track Every Rupee : Know where your money really goes

-

All-in-One Dashboard : Connect multiple accounts for total clarity

-

Shared Household Budgets : Great for couples and families via family budgeting tools

Ready to make your money work for you? Download TimelyBills now and get started in minutes.

The 50/40/10 rule isn’t about perfection—it’s about progress.

It gives you structure, peace of mind, and enough flexibility to enjoy life while building a better future. Whether you're earning ₹25K or ₹2.5L a month, the rule can work—because it's built on habits, not numbers.

So… are you ready to stop stressing and start building?

We’d love to hear how you budget! Have tips to share or questions about how to make this work for your lifestyle? Drop them in the comments!

Related Reads from TimelyBills Blog

Frequently Asked Questions (FAQs)

1. What is the 50/40/10 rule in budgeting?

It’s a financial strategy where you spend 50% of your income on needs, 40% on savings or investments, and 10% on personal wants or entertainment.

2. Is the 50/40/10 budget rule suitable for all income levels?

Yes! It’s flexible. Even if your income is lower or fluctuates, you can use the same percentages to guide your spending.

3. How can I stick to this budget every month?

Use a budgeting app like TimelyBills. It tracks your expenses automatically and alerts you when you're near your spending limits.

4. Can I adjust the percentages to fit my situation?

Absolutely. It’s a framework, not a rigid rule. Adjust as needed—just keep the focus on building savings and limiting unnecessary expenses.

5. How does TimelyBills help with financial planning?

With tools for budgeting, bill reminders, goal tracking, and real-time reports, TimelyBills supports your financial health every step of the way.

Suggested Alternate Titles for SEO Optimization:

-

Master the 50/40/10 Budget Rule: Your Key to Smarter Spending & Saving

-

How to Use the 50/40/10 Rule to Build Wealth Without Giving Up Fun

-

The 50/40/10 Method: Balance Your Budget, Boost Your Bank Account

Would you like the same article optimized for mobile SEO, voice search queries, or in rich snippet format for Google SGE and AEO visibility? I can also prepare structured schema markup and meta descriptions if needed.

Download the app and get started on your money saving journey

© Copyrights 2025 TimelyBills. All rights reserved.